FCMB and Sustainability

With a vision to be the premier financial services group of African origin, we are committed to corporate governance, sustainable value creation and applying effective risk management principles in our operations, knowing that achieving our vision depends on stakeholders’ long-term success and the environment we do business.

FCMB Group Plc has over 3000 employees driving operations in 275 branches, cash centres, flexxhubs, micro-finance and agency banking centres across Nigeria, making the group one of the country’s foremost financial institutions and a significant contributor to Nigeria’s economic development.

We believe that building a successful and sustainable business goes beyond financial performance; it matters more how we achieve success than what we achieve. Our technology-powered ecosystem ensures that we lend responsibly, promote financial inclusion, encourage diversity, adhere to health and safety standards, and reduce (or avoid totally, where possible) negative environmental impact as we grow.

Building a Resilient Ecosystem

A resilient ecosystem is meant to deliver values to its stakeholders at scale, with speed, and must consider everyone’s needs. Hence, we are building an ecosystem of connected platforms, products and services (third-party included) to deliver significant inclusive growth and prosperity for all stakeholders while growing capital and purposefully impacting our business communities. Our ecosystem model is Platforms–Products and Services ( 3rd-party included ) – Capital–Customers.

|

Platforms: gaining traction & profit growth. |

Products: | 3rd Party Products and Services: | Capital: | Customers |

|---|---|---|---|---|

|

|

|

|

|

FCMB is committed to the Net-Zero Carbon Emission and Climate Change Action race. We are ensuring net-zero emissions in our operations by reducing our energy consumption. We are doing this by effectively monitoring energy usage, instilling corporate recycling practices while identifying positive mainstream climate actions, and ensuring financing flow to sustainable development priorities, businesses, the economy and achieving the United Nation's Sustainable Development Goals.

We aim to support the country's Nationally Determined Contributions (NDC) along the lines of the 26th United Nations Climate Change Conference (COP26) to meet a low-carbon economy and, subsequently, a net-zero carbon planet. Also, we have strengthened our Climate Financing Capacity and Opportunities by participating in workshops organized by leading local and international partners.

FCMB constantly keeps abreast of emerging Environmental and Social Risks (E&S) around Climate, Human Rights, and other social issues like Gender-Based Violence and Harassment (GBVH) with partnership opportunities with the UNGC, IFC and other relevant global change players.

In a demonstration of commitment to sustainability, First City Monument Bank (FCMB) has scaled up its clean energy operational practice and financing while also taking its branches off the national grid and diesel generators to solar power as the primary energy source.

As a bank, to address UN SDG-7 “Affordable and Clean Energy”, most of our branches currently run on solar energy. About one hundred forty-nine (149) branches and 573 ATMs now run on Solar Energy, compared to 101 branches and 303 ATMs in 2020, reducing our carbon footprint by 60%. Our investments have been spread across the renewable energy spectrum of mini-grids, commercial and industrial Energy-as-a-Service sources and Solar Home Systems (SHS). We have also strengthened partnerships with key institutions like the Nigeria Energy Support Programme (NESP) as the first-choice financier of all eight (8) developers profiled for the Interconnected Mini-grid Accelerated Scheme. This is in addition to several large ticket projects facilitated by the Solar Naija Programme of the Rural Electrification Agency.

We have always worked to reduce the environmental impacts of our business by operating in an environmentally-friendly and responsible manner while complying with legislation and other legal requirements. We recognise that though minimal, our operations result in some environmental impact. As part of efforts to minimise our ecological footprints, we have identified specific areas where the Bank has the most impact as follows:

- Energy: 150 branches currently operate with Solar/Hybrid Energy reducing carbon emission/pollution to our operating environment

- Paper Usage: we have reduced Paper Usage by 85% YoY, with proper awareness among all employees.

- Water Usage: we built a water treatment plant at our Head Office and three other strategic locations to reuse water for other valuable purposes

- Solid Waste Management: we have partnered with companies to practice circular-economy by re-packaging paper and cartons to tissue paper, another essential item in our daily operating system

- Company Fleet: We have staff buses moving employees to various locations to encourage commuting to reduce carbon pollution substantially

- Air travel: we have institutionalised Microsoft teams for our meetings, reporting and presentation to manage employees' deliverables effectively

- Third-Party Environmental & Social Issues (i.e. Vendors, Contractors etc.): we have built a platform which constantly informs our vendors of safe and best practices in their relationship with FCMB

- Corporate Recycling: Corporate Recycling is at strategic business locations – saving 25% waste to landfills

- Environmental Audit: we are 100% audited to operate in a safe and healthy business environs

The goal remains to reduce branch footfall, improve customer experience, and drive financial inclusion, especially in difficult-to-reach areas nationwide.

Our Strategy

FCMB, as one of Nigeria’s leading banks, with over 3,000 employees, and through our daily operations with about 275 branches and business locations across the country, remains a pillar in the Nigerian economy and a significant contributor to social and economic development. We are committed to building a resilient economy. This goes beyond financial performance or what we achieve; it is about how we achieve our success stories.

Our business is built on decisions focused on society, the planet and our critical stakeholders. As a responsible corporate citizen, creating value is at the centre of our approach to achieving our purpose-driven ecosystem; to unlock the power of finance to change lives for everyone, today and future generations. In time, we intend to advance the regenerative money ecosystem at scale; that is, we want to provide expansive and comprehensive support for sustainable financing that protects, renews and restores the environment, improves customers’ livelihoods and enhances the resilience and well-being of our host communities.

We hope our commitments to sustainable financing, customers’ livelihoods, human rights risks, and our Purpose Assurance strategy grounded in a data-driven approach will be a great example of positively impacting the planet and the people.

FCMB will continue to push the border of innovation, making the work-life balance as rewarding as possible and creating a conducive working environment.

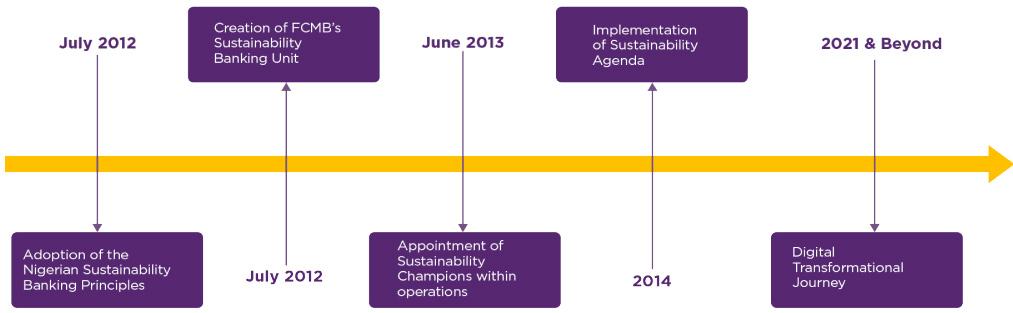

Our Corporate Sustainability Journey

Adoption of the Nigerian Sustainable Banking

principles(NSBP) in our process

At FCMB, our sustainability agenda is underpinned by the nine pillars of the Nigerian Sustainable Banking Principles (NSBPs) developed and adopted by the Bankers’ Committee in 2012. The NSBPs encourage banks to promote economic growth and business opportunities, and enhance innovation and competitiveness, whilst protecting communities and the environment in the normal course of duty.

As a responsible lender, we actively manage environmental and social risks. In addition, we support business opportunities that align with sustainability principles.

We integrate environmental and social considerations into decision-making processes, relating to our business activities to avoid, minimize or offset negative impacts. As a responsible lender, we actively manage environmental and social risks, support business opportunities and reduce the impact of our operations. This goal is enforced through the development of robust policies and procedures aimed at integrating Social and Environmental Management System (SEMS) initiatives into our lending process.

Our SEMS policy is to ensure that environmental and social commitment forms an integral part of our operations and processes. We manage processes to identify risks associated with borrower's activities and projects by providing guidelines to conduct business in a manner that will promote and protect the health and safety of employees, customers and the public.

Also, we devise various action plans to avoid, minimize or mitigate social and environmental challenges. We also engage in post disbursement monitoring, reporting and compliance with the Nigerian Sustainability Banking Principles and other applicable environmental legislation's as well as internal policies and guidelines.

We avoid, minimize or offset the negative impacts of our Business Operations on the environment and local communities with which we operate and where possible, promote positive impacts.

Environmental Footprint:

FCMB has identified the key areas where our business impacts the environment as follows: energy consumption and efficiency, waste production and management, paper usage and transportation and water consumption. We are committed to reducing our overall environmental footprint and actively taking steps to achieve this. The steps are:

- Evening shut down policy to reduce energy consumption and carbon emissions

- Annual participation in the World Environment Day

- Tracking of printing costs and paper usage

- E-products that help to reduce paper usage

- Use of online documents for meetings to reduce print requirements

- Investment in teleconferencing to reduce travel to meetings

- Usage of Microsoft Teams to hold meetings and reduce carbon emission via road transport

- Deployment of E-learning Platform to achieve seamless access to online trainings, bridging knowledge gaps

- Introduction of busses used for mass commuting of staff

- Dual-flush of toilets at Head Office to help save water, with potential installation across our offices if successful

- Corporate recycling to cultivate the habit of collection and re-use of recyclable items

- 149 branches currently run on solar energy alongside six Flexx Hubs

- In addition, knowledge improvement program (KIP) are held continually to sensitize the bank staff on the importance of SEMS, thereby promoting a culture of personal adherence to SEMS principles. An E-learning course on SEMS has also been employed.

Social Footprint:

Our Employees

We are committed to improving the livelihood of our employees through effective engagements, health programmes, training and adequate compensation. As an equal opportunity employer, we are committed to providing a safe and conducive work environment for all our employees, including the physically challenged, to enable them carry out their duties in line with the Group’s strategic objectives whilst developing their careers. The Group currently has a few individuals with disabilities in its workforce. These include visually impaired staff and employees with prosthetic limbs, all of whom carry out their duties professionally.Work-Life Balance

FCMB is committed to a work-life balance for its employees. The Group accommodates flexible working hours and employees could be deployed or redeployed to branches and offices close to their homes. The Group pays attention to promoting and preserving quality time for its employees to spend with family and loved ones. A few initiatives include:

- Our shutdown policy, which mandates branches to shut down at 7pm. It is to ensure that employees do not stay late in the office.

- Weekend assignments are not encouraged and where unavoidable, an employee is not supposed to work more than one Saturday per month. While we place great value on training our employees, weekend training sessions have been drastically reduced. We have invested in the use of technology, with our employees having the flexibility of continuous learning via online platforms.

- Yearly Health week and Family Fitness Day.

Training and Development

Giving preference to Training and Development reflects how we value our staff and their personal growth within and outside the industry. While the fear of investing in people and losing them to competitors has significantly reduced organizations’ investments in training, we still invest heavily in staff training, preparing them for all-round customers' best experience. Convinced with the idea that staff training has a direct bearing on overall performance and service quality, the Bank has pushed Training and Development to the center of her businesses and can at all time boast of a talented workforce, well equipped to deliver her comprehensive bouquet of financial services.In line with the commitment to harnessing our employees’ potential through continuous learning and development, we have created a dedicated Training Academy, which designs and delivers a range of programmes to address our employees’ learning and development needs. Each employee is encouraged to undergo 60 hours of training and development annually, through a combination of classroom and online programmes. To show how well we have fared in training and investment in our staff, the academy has received a number of industry awards attesting to this fact, such as the Best Contributing Employer in Human Resource Development by Industrial Training Funds in 2017, and the Great Place to Work Award by the Great Place to Work Institute in 2018.

We can confidently say that our improved rating in the industry, particularly on excellence service delivery could be linked with the huge investment in staff training. In 2016 for instance, the Group invested over N800 million in staff training and development and this has rightly positioned the staff for the anticipated disruptions in the world of financial services.

Mentoring Schemes

As part of the learning and career development plan for overall organizational Effectiveness, we have mentoring programs in place. The mentoring Program is targeted at employees who were recruited into the Bank through our six months Management Development Program as well as women in middle management level in the Bank. We also register members of our top management (Operational and Strategic leaders) for a structured, one-on-one executive coaching program, which spans for a period of 3–6 months. The Coaching and Mentoring Programs are being deployed by external consultants (Certified Coaches) and selected senior employees of the Bank respectively, in addition to other enhanced learning programs conducted during the year.Career Development Opportunities

FCMB has the following initiatives in place to provide employees with improved career development opportunities:

- A dedicated career management desk to address all employee career management and development activities within the organization

- A career management portal where employees can identify potential career opportunities and chart a career path trajectory within the organization

Employee Surveys

We are committed to making FCMB a Great Place to Work and our talent attrition target is less than 2% of total talent pool. Through the annual Employee Survey, an exercise initiated over three years ago, we have been able to measure employee engagement and loyalty. More importantly, it gives us bottom-up feedback to foster understanding of the issues that need to be addressed in order to make FCMB a Great Place to Work. For each employee category, results reveal what the Group is doing right and areas for improvement. Each employee’s evolution from one year to another is monitored and key performance indicators, within our core values of Execution, Professionalism, Innovation and Customer Focus, are attached to them.Providing Access for our Customers with Disabilities

FCMB is committed to ensuring that possessing a disability is not a hindrance to accessing our services. Consequently, 25 of the Bank’s branches have wheelchair ramps and there is a plan in place to install these at more branches. This aligns with our promise to be a helpful institution. We also have friendly, courteous and professional staff who go the extra mile to create a convenient environment and experience for customers, including those with special requirements.

We respect human rights in our Business Operations and Business Activities. FCMB has fair recruitment practices that are non-discriminatory. We also practice fair remuneration across similar skills and responsibility sets. The Group has embedded human rights principles into its governance policies across the board. The stand-alone Human Rights policy, which expresses FCMB’s commitment towards respecting and promoting human rights, is also being revised. In addition, as part of our Social and Environmental Management System, the Group’s site visitation team note human rights issues as part of the system’s checklist to ensure our clients are not violating human rights.

We promote women’s economic empowerment through a gender inclusive workplace culture in our Business Operations and services designed specifically to women through our Business Activities.

The Group has a non-discriminatory hiring policy. About 41.5 % of our employees are women, and we currently have nine women in upper management holding key roles in the Group, including the Executive Director for Finance, Executive Director for Business Development, Company Secretary and Group Legal Counsel, Human Resources, Transaction Banking, Corporate Banking, Investment banking and the Chief Risk Officer – posts which could collectively be referred to as the bedrock of banking itself. FCMB has a Women’s Network, which serves as a mentorship platform for young female employees within the Group. FCMB created the Women in Business Unit to support women entrepreneurs and growing their businesses through various platforms. FCMB Women also unite to support less privileged communities and children through donations and active voluntary services. The Group supports women-owned businesses, automates the tracking of “women owned/managed business” and makes provisions that enable women to harness available business opportunities.

We promote financial inclusion, seeking to provide financial services to individuals and communities that traditionally have had limited or no access to the formal financial sector.

FCMB’s operating companies have innovative products and services designed to cater for the under-banked, unbanked and disadvantaged individuals in society. We have also simplified our services with technology driven processes to enable more people have access to financial services which encourages a positive and rewarding savings culture. Such products include Nairawise accounts, Wallets accounts and the Agent Banking, which are all in line with the Central Bank of Nigeria’s financial inclusion agenda.

- EASY ACCOUNT: FCMB launched its innovative Easy Account where your phone number is your account number. To open this new account which requires no documentation, BVN, paperwork or opening balance, all you need to do is dial the Bank’s USSD *329# on any phone. This initiative is to make everyone financially included irrespective of their location. Learn More

-

FCMB Agent banking started three years ago with a revamped solution introduced in May 2017 with a total of 486 agents as at November 2018 nationwide Agent Banking is a simple user friendly and cost effective way of providing secured light banking services such as Cash deposit, Cash withdrawal, Fund transfer, Bills payment, Airtime Recharge etc. to groups of people in a community, employing known and trusted existing retail business outlets in the same community. It is a cost-effective solution designed to provide financial access to the unbanked and underbanked population. Which is aimed at reducing financial exclusion to 20% by the year 2020. Agency banking ‘outlets’ act as the locations where the un-banked or under-served persons transact. These outlets are owned by individuals or entity who will offer payment services to the customer and by doing so earn transactional income for the services they offer. Learn More

- E-Savings: An electronic savings account through which a customer completes the account opening process without filling out physical form(s) or visiting the bank. This process was introduced in line with the Central Bank of Nigeria’s “Know Your Customer” requirements.

- FCMB Flexx is a uniquely designed savings account that allows students, corpers and young professionals between the ages 18-30 years carry out banking transactions using our convenient, fast and efficient alternate channels primarily, (ATMs, Mobile/Online banking, *329# USSD Platform and POS terminals). The aim of the account is to inculcate savings habit into the lifestyle of young people while empowering them for the future. Learn More

- The Group Lending Micro Credit Business of the Bank was set up in 2015 to facilitate financial empowerment to clients within the informal segment who are predominantly unbanked and underbanked active poor women within the society, thereby ameliorating pursuing the dual social and financial goals. The Group lending unit has been established in 62 FCMB branches across 13 States of the Federation. It is noteworthy to state that over 142,000 clients have been financially included through this scheme with the disbursement of about N15 billion loans. The bank has instituted a micro-finance model in which small-scale loans of N 100,000 each or less are made available to many micro enterprises to support and grow their businesses.

We implement robust and transparent E & S governance practices in our respective institutions and assess the E & S governance practices of our clients. FCMB’s Sustainability Team was created in 2012 to co-ordinate the overall implementation of the Nigerian Sustainable Banking Principles across business activities and operations. To further support the activities of the team, we have appointed sustainability champions within operations, administration, human resources and credit risk management. A Social and Environmental Management Systems (SEMS) officer ensures effective oversight of E&S risk management, especially as it relates to the Group’s business activities. The corporate social responsibility and sustainability teams ensure that the Group’s sustainability agenda is promoted through the business operations. Also, the bank has instituted a Sustainability Steering Committee (SSC) for effective implementation of the bank’s commitments towards sustainability. The SSC’s main purpose is to foster a culture of sustainability at FCMB through planning and managing the integration of the bank’s sustainability strategy as approved by Executive Management.

We develop individual institutional and sector capacity necessary to identify, assess and manage the environmental and social risks and opportunities associated with our Business Activities and Business Operations. Social and Environmental Management Systems (SEMS) principles have been institutionalized to promote ownership. This includes regular training of staff via e-learning, the in-house Knowledge Improvement Program - “KIP” and train-the-trainer initiatives. This is now a requirement for all staff and has significant weighting in the appraisal system

We have spent time and resources in providing training for relevant stakeholders including our business team, forming collaborations with multilateral agencies including FMO and IFC to ensuring advisory and best practices are delivered to our customers and staff. Finally, we are beginning to see results, with improved E&S practices and adoption from our customers. Also, the awareness of our business team has become sharpened following this, about 2000 employees (including senior management) completed the Managing Environmental and Social Performance and the International Finance Corporation’s (IFC) sustainability training on FCMB’s e-learning programme (STEP), comprising 13 modules.

Our engagement with other players in the industry and major multilateral agencies, like the IFC and FMO (the Dutch development bank), also provides crucial support and knowledge transfer. The Group also supports capacity building for the media to enhance their reporting skills – In October 2018, FCMB organised a capacity building programme/media parley for 50 journalists. This is hinged on sustainability since its inception in September 2014.

In addition, FCMB signed up for training on Financial Analyses for Renewable Energy/Energy Efficiency and related matters through the Winrock International/USAID Nigeria Renewable Energy and Energy Efficiency Project Capacity Building Programme. Some staff have also undergone training on Sustainable Energy Finance anchored by IFC staff.

We believe as a bank we have been very open in adopting principles that would support E&S Risk in dealing with various transactions and have been thorough in setting policies and procedures to driving their implementations across board.

We collaborate across the sector and leverage international partnerships to accelerate our collective progress and move the sector as one, ensuring our approach is consistent with international standards and Nigerian development needs.

FCMB recently formed partnerships and participated in several trainings with the aim of improving its sustainability focus and as a responsible and forward-looking organisation which has Sustainability in its core values. The partnerships which include: the Nigerian Conservation Foundation, a foremost environmental NGO that is dedicated to nature conservation and sustainable development in Nigeria. On this, we have participated in supporting the annual "World Environment Day". The 2018 edition came with the theme - Beat the Plastic Pollution, on the need to recycle and upcycle plastics amongst several of their initiatives while the 2019 theme spoke on “Beat Air Pollution” in a way to combat environmental degradation. The 2020 theme depicted “Time for Nature”, with a focus on its role in providing the essential infrastructure that supports life on Earth and human development. In 2021, World Environment Day theme focused on “Ecosystem Restoration”, a global mission to revive billions of hectares, from forests to farmlands, from the top of mountains to the depth of the sea. The 2022 edition came with the theme “Only One Earth” with focus on “Living Sustainably in Harmony with Nature”. However, 2023 was themed – Solutions to Plastic Pollution.

Other partnerships include those with IFC, FMO, AGF and GIZ. Our partnerships with these multilateral organisations have put FCMB in the fore front of driving Sustainable /Climate Finance related investment in the country. We are proud to say we are signatories to the United Nation Global Compact (UNGC) with the sole focus of implementing its universally accepted sustainable principles.

We have also worked with indigenous companies and NGOs to pursue various financially and socially inclusive programmes including Agency Banking initiatives with local businesses, fashion and renewables with Kinabuti Fashion Initiative, MITMETH, Tulsi Chanrai Foundation, Nigeria Conservation Foundation , WeForGood , Youth Empowerment Foundation, House of Tara, Doreo Partners, SOCASEMP, Jakin NGO are but a few on the list. Here our intent includes empowering businesses, young person and individuals at the BoP level.

FCMB had several trainings from multilateral agencies/development banks include Climate Eligibility Training from the IFC and Green Lending from the Dutch FMO. Also, worthy of mention is sector specific trainings we’ve had with the African Development Bank (AfDB), Risk Managers Association of Nigeria (RIMAN) and the Nigerian Sustainable Banking Principle (NSBP) Steering Committee. Our end goal is to drive more sustainable business initiative and empower or customers to becoming more energy efficient and responsible to the environment.

Finally, we were host to our SME’s customer with the aim of providing targeted investments and technical support to energy access companies in various sectors of the Nigerian economy. This was in partnership with the IFC and World Bank. In order that we act responsible during our operations, we also partnered with Recycle Points, to drive Corporate Recycling to help with proper sorting/segmentation of work place wastes and disposal.

We regularly review and report on our progress in meeting these principles at an individual and sector level. To ensure real integration of sustainability into its strategy and processes, FCMB has instituted internal quarterly reporting on sustainability which enables the Group to monitor its progress and address issues in an independent manner. FCMB complies with the CBN’s one-off and semi-annual reports in line with the NSBPs (Nigerian Sustainable Banking Principles). FCMB submits periodic reports to the International Finance Corporation on Social and Environmental Management Systems (SEMS). Also, SEMS has been included as a reportable event under the Bank’s whistle blowing policy. Additionally, Report is made to NDIC ( Nigeria Deposit Insurance Commission).

Other Activities

- To foster awareness of the Group’s position on human rights

-

To enhance the Group’s capability to identify and manage

human rights issues in areas relevant to our business,

such as:

- Employees

- Vendors

- Contractors

- Business Partners

- Customers

- Communities

- Anticipating and managing workplace health risks to protect people

- Promoting health and wellbeing by offering programs and solutions encouraging people to take responsibility and adopt an approach of “learn, feel and choose.”

- Supporting people during and after injuries and/or illnesses for optimum health outcomes

- Fostering an environment where employees experience a caring leadership underpinned by the principles of respecting privacy and personal choices, enabling informed decision-making, and supporting a healthy working environment and conditions

ENABLERS

Governance and Incentives

Human rights are embedded at all levels of our governance structure,

creating incentives that drive continuous

improvement among our employees. Also, we have set out clear roles and

responsibilities within the system to ensure

respect for human rights. Moreso, at the Board of Directors level, the

sustainability committee conducts due diligence,

giving feedback on areas with significant risks to human rights and ways to

address those risks.

Policies and control systems: At FCMB, we leverage our policies and control systems to ensure human rights are embedded in the organisation’s operational guidelines. As part of bringing human rights under our control systems, we have implemented various tools to aid reporting on training, compliance and audit results. We have also improved how we communicate our policy commitments to all our stakeholders as part of our commitment to transparent engagement on human rights.

Engagement and Advocacy: Engagement and advocacy have become key characteristics embedded in our human rights. We engage with key stakeholders to advocate for SMART due diligence legislation and collective action. We have also supported appropriate legislation that leads companies to greater action, networking and transparency.

Strategic Partnerships: We partner with thought-leading governmental and non-governmental organisations, locally and internationally, to share learnings, build common approaches and frameworks, and significantly invest in relationships with actors at all levels to protect and promote human rights, e.g. UNGC, NCF, UNEP-FI, BcTA, AfDB, IFC.

Transparency and reporting: From time to time, we provide high-level transparency of the progress we make and the challenges we face. We also hold ourselves to high standards of transparency by regularly reporting on our achievements and performance and sharing our shortcomings and challenges.

Statement of Compliance with the SEC Code of Corporate Governance: In compliance with Section 34.7 of the Securities and Exchange Commission (SEC) Code of Corporate Governance for Public Companies in Nigeria (the Code), which governs the operations of FCMB Group Plc, the Board confirms compliance with the Code as disclosed in the Annual Report and Accounts.

Sustainable Governance at FCMB

These are:

- Board of Directors:

- Leadership Team

- Sustainability Committee (Steering Committee)

- Sustainability Committee (Working Committee)

- Board of Directors: Sustainability, which encompasses environmental, social and governance (ESG) matters and the UN’s Sustainable Development Goals (SDGs), is increasingly being positioned at the top of the Board’s agenda. At FCMB, sustainability is now central to our strategic planning. At this level, decisions about empowering and enlightening people and preserving the environment are made. Also, we have set out clear roles and responsibilities within the system to ensure sustainable business financing.

- Leadership Team: the team considers sustainability issues; for example, environmental and social issues, that identify the ESG factors that are materials to our business and ensure that they are monitored and managed.

- Sustainability Steering Committee: the steering committee has responsibility for developing the sustainability agenda for our business and overseeing the attainment and progress of the compass strategy across our Nigerian operations. Also, our steering committee consists of working committee members and selected leadership team members.

- Sustainability Working Committee: this committee plays a central role in our governance structure. The committee comprises a dedicated team of employees responsible for coordinating and implementing sustainability initiatives in Nigeria. The team integrates sustainability into the Bank’s operations, engaging diverse stakeholder groups to create sustainable value for our business and society.