- PERSONAL BANKING

- BUSINESS BANKING

- CORPORATE BANKING

- GROUP & SUBSIDIARIES

- ABOUT US

- MY BANK AND I

Thank you for your interest in FCMB Visa Credit Card. At First City Monument Bank (FCMB), we believe in earning your trust by presenting information in a clear and transparent manner. This FAQ has been prepared to provide you with all necessary information to enable you request your FCMB VISA Credit Card and use it for your everyday expenses at home and abroad.

FCMB Visa Credit Card is an electronic payment tool with a revolving credit line. This Card is a Naira denominated and internationally accepted credit card in the market. You can use it in any currency and your monthly repayments will be in Naira. It is internationally accepted at over 170 million outlets and you can withdraw cash at any ATM in the world where the VISA logo is displayed. You can choose to fully pay back the amount used on your card plus transaction fees on or before the payment due date. If you do so, you will enjoy an interest free period of up to 40 days.

Please note the following key information associated with your Credit Card:

Monthly Payment Due Date

- The Minimum Monthly Payment Due is 10% of the total spend* plus any interest, fees, charges and over-limit amount. The methodology of calculating the minimum amount due can be changed to a dynamic mode at the sole discretion of the Bank i.e., the minimum amount due can change from month to month depending on your Card usage, repayment behaviour and applicable fees and charges.

- Monthly payment due date is stipulated on the Credit Card statement. If this date falls on a Bank holiday, the due date will be the first working day after the due date.

- If you do not make full payment, interest will be calculated at 3% and 1.5% per month for Unsecured and Secured credit cards respectively.

*Total Spend means: Cash withdrawals and all other transactions

*Cash Advance means: Cash Withdrawals only

Tariff

|

Fees |

Classic |

Gold |

|

Quarterly Maintenance Fee (Primary Card) |

|

|

|

Quarterly Maintenance Fee (Supplementary Card) |

|

|

|

Monthly Interest Rate |

3% |

3% |

The Quarterly Maintenance Fee is charged at the end of each statement cycle which commences from the date your card is activated.

|

Other Fees |

Classic |

Gold |

|

Cash Advance Fee (FCMB) |

|

|

|

Cash Advance Fee (Other Banks) |

|

|

|

Cash Advance Fee (International) |

|

|

|

Card Replacement/Reissue Fee |

|

|

|

PIN Reissue Fee |

|

|

|

Exceeding the set credit limit fee |

3% of Excess Amount |

3% of Excess Amount |

|

Late Payment fee |

|

|

|

SMS Charges (per transaction) |

N4 |

N4 |

| Annual Credit Limit fee | N2000 | N2500 |

Please note that all charges are subject to change by the Bank.

Frequently asked questions (faqs) - visa credit card

Card application

Q: what are the types of visa credit cards available?

Visa Credit Card comes in Classic and Gold variants.

Q: how do i get a visa credit card?

It's easy! - Simply walk into any FCMB Bank branch and complete the application form with the required documentation for Visa Credit Card.

Card Activation

Q: can i start using my card once i collect it from the branch?

No. The card has to be activated before use.

Q: how do i activate my visa credit card after collection?

It's easy! - Simply follow the steps below

Step 1 - Call Contact Centre on 01-2798800 or (07003290000)

Step 2 - Provide your name and card expiry date (Card masked PAN and card expiry date)

Step 3 - A Contact Centre agent will ask you some security questions

Step 4 - Once questions in step 3 are answered correctly, the card is activated within 30 minutes

Step 5 - You can now change your PIN at any FCMB ATM

Q: what is pin?

This is the PIN (Personal Identification Number) utilised for ATM, POS and Online Transactions. You can generate this PIN yourself.

Q: how do i generate my pin?

There is a default PIN that comes with the Visa Credit Card which is 0000. Simply go to any FCMB ATM and change the default pin to your desired 4-digit PIN.

Q: is there any other pin?

Yes, it is called Web Transaction PIN. (I-PIN) This is the PIN that is utilised for online transactions on merchant websites with extra security layer called Verified by Visa (VbV).

Q: how do i generate my web transaction pin?

It's easy! - Simply follow the steps below

Step 1 - Enter your 4-digit PIN

Step 2 - Select change PIN

Step 3 - Select Web Transaction PIN (I-PIN)

Step 4 - Enter desired Web Transaction PIN

Step 5 - Re-enter Web Transaction PIN

Note: Web Transaction PIN must be different from the normal ATM PIN.

Card Usage & Default

Q: how does my visa credit card work?

A Credit line with an assigned limit is set up for every cardholder. Cardholders can spend within the assigned limit and repay at the due date. If a cardholder exceeds his credit limit for any reason, a fee would be applied as captured on the fee table below. (Refer to the card pricing section on this document).

Q: where can i use my visa credit card?

The Visa Credit Card can be used on ATMs, POS machines and the internet. Your card is internationally accepted as a means of payment at over 24 million merchant locations and over 1 million ATMs worldwide, in over 170 countries.

Q: how do i get my monthly statement of account?

Your monthly statement is sent to your email address on the statement date.

Q: when do i make monthly settlement on my credit card?

FCMB Visa Credit Cardholders are expected to repay their credit card bills on or before payment due date indicated on your monthly statement.

Q: how is my credit card statement date and payment due date determined?

Your credit card statement date and payment due date are determined by your salary payment date.

Below is a table showing different salary payment dates and their respective billing cycles:

|

Billing Cycle Guide |

||||||

|---|---|---|---|---|---|---|

|

Salary Payment Date |

28th-30th |

23th-27th |

18th-22nd |

7th-17th |

3rd – 6th |

31st – 2nd |

|

Statement Date |

20th |

17th |

12th |

7th |

27th |

23rd |

|

Payment Due Date |

30th |

27th |

22nd |

17th |

6th |

2nd |

Interest

If you cannot fully repay the outstanding amount before the payment due date, please pay back as much of your outstanding balance as possible in order to reduce the interest. It is charged on the amount outstanding on your card after the payment due date.

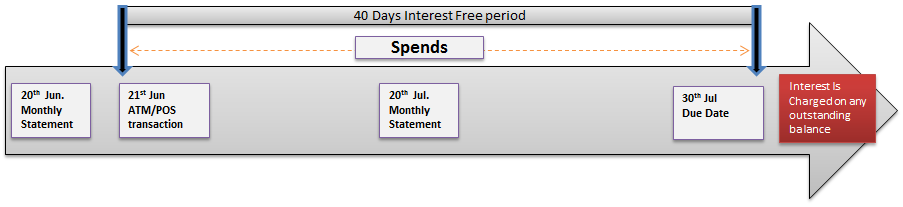

* 40 days free of interest

If you spend at the beginning of a new cycle (21st) and settle full amount on due date (30th), no interest is charged to your card in the next cycle.

Where the full amount is not settled on the due date, an interest of 3% (Unsecured Credit Card) or 1.5% (Secured Credit Card) will apply on the outstanding amount on your card at the end of the next cycle.

Q: how are repayments made?

A standing instruction would be placed on your salary account (repayment account) from which monthly repayments would be debited as and when due. Customers can also choose to pay cash or cheque or make a transfer into the card account.

Q: how much am i expected to settle monthly?

Minimum repayment is 10% of your outstanding balance every month.

Q: can i withdraw cash across the counter from my visa credit card?

No, please.

Q: can i pay cash into my visa credit card?

Yes, please.

Q: what are the consequences if i do not settle up to the minimum due of 10% of outstanding?

A late payment fee of N2, 000 flat will apply whenever a customer defaults. The card status shall be blocked if repayments are not made on or before 45 days past due (dpd) until the customer repays 20% of his/her outstanding balance; 50% for 60dpd and 100% for 90dpd.

Q: how long can i use my visa credit card?

Card can be utilised until the expiration date shown on the card. Once the card is expired, you can make a request for a new card at any FCMB branch close to you.

Q: what are the required documentations?

|

Card Type |

Target Customers |

Employer |

Customer Type |

Documentation |

|

Unsecured Credit Card (Clean Credit) |

Salary Earners |

Must be Categorized |

Existing Salary Plus Loan Customers

|

|

|

Non Borrowing Salary Earners

|

|

|||

|

Secured Credit Card |

Non-Salaried Customers |

Nil |

Self-employed Customers (Business Men, Traders, Travellers, Tourists etc)

|

|

Q: what are the common reasons my visa credit card application can be declined?

Customer’s application may be declined due to the following reasons:

- Bad Credit history on existing loans

- High Debt Burden Ratio -DBR; (where Maximum DBR for product is 40%)

- Insufficient credit limit (where Minimum Credit limit is N25,000)

- Low income (where Minimum Monthly Net Income is N40,000)

- High volume of returned cheques etc.

However, this application may be reviewed in the future in line with the bank’s underwriting criteria and credit policy.

Transaction Decline & Stolen Cards

Q: what are the common reasons my visa credit card transactions can be declined?

Your FCMB Visa Credit card transactions can be declined for a number of reasons including:

- Card has not been activated

- Wrong PIN being used (use of wrong PIN three consecutive times will block your card)

- Wrong expiry date for Internet transactions

- Wrong security code on internet payments

- Exceeding daily ATM withdrawal or POS limit

- Supply of an address inconsistent with the address indicated on the card application form.

What should i do if my visa credit card is lost or stolen?

Customers are expected to report lost or stolen cards immediately by calling any of the following numbers (07003290000) , 01-2798800 and request that the card be hot listed immediately. You will be asked a few questions to confirm that you are the actual owner of the card.

Other Key Points To Note

- All transactions outside Nigeria will be converted to Nigerian Naira (

N) at the prevailing exchange rate when such transactions are processed. - The card is only activated after you call the Bank on the provided hotline, subject to preliminary security verification.

- As required by law, we will share your credit data with credit bureau and other financial regulators.

- This document is for your information and does not replace your Credit Card agreement.

- The bank will ensure that your renewal card is produced and make all reasonable efforts to deliver it to you before the final date of the month of expiry mentioned on your credit card.

- When travelling overseas, please remember to inform us of your planned itinerary to help us ensure that you do not experience any service disruption.

- Benefits and features such as Cash Back, Reward Points, Discount offers and any other offer are provided on the Credit Card at the sole discretion of FCMB and may be withdrawn, amended or replaced without notice. FCMB is not responsible for any dissatisfaction with regard to delivery, quality and service of the offers. Offers are valid only when payments are made using the FCMB Credit Card and not valid in conjunction with any other promotion/offer. The Bank shall not be liable whatsoever to the Cardholder in respect of any loss or damage arising directly or indirectly from the offers.

- Please remember to examine your monthly Credit Card Statement and inform us of any discrepancy within 30 days from the statement date, otherwise it will be considered as correct. In case you need to dispute some transactions within your Credit Card Statement, please contact us on +234 (0) 1279 8800 , 07003290000 or visit any of our branches.

For additional information, please call our 24/7 Contact Centre on +234 (0) 1279 8800 , 07003290000 email us at customerservice@fcmb.com or contact the nearest FCMB branch.

Full terms and conditions are applicable.

Thank you.